The 24 hr Global Investment World

Steelwood Capital and the DTI Method

The reality is that many investors do not realize we all live in a truly 24-hour “global” market. The markets essentially never sleep as they are traded around the world each day. Before the U.S. Market opens, Asia has already finished their day and the European Market is winding down. This means that what happens during the actual U.S. trading day is just a small part of the overall trading picture. Investors who do not realize the importance of the 24-hour global market put themselves at a distinct disadvantage.

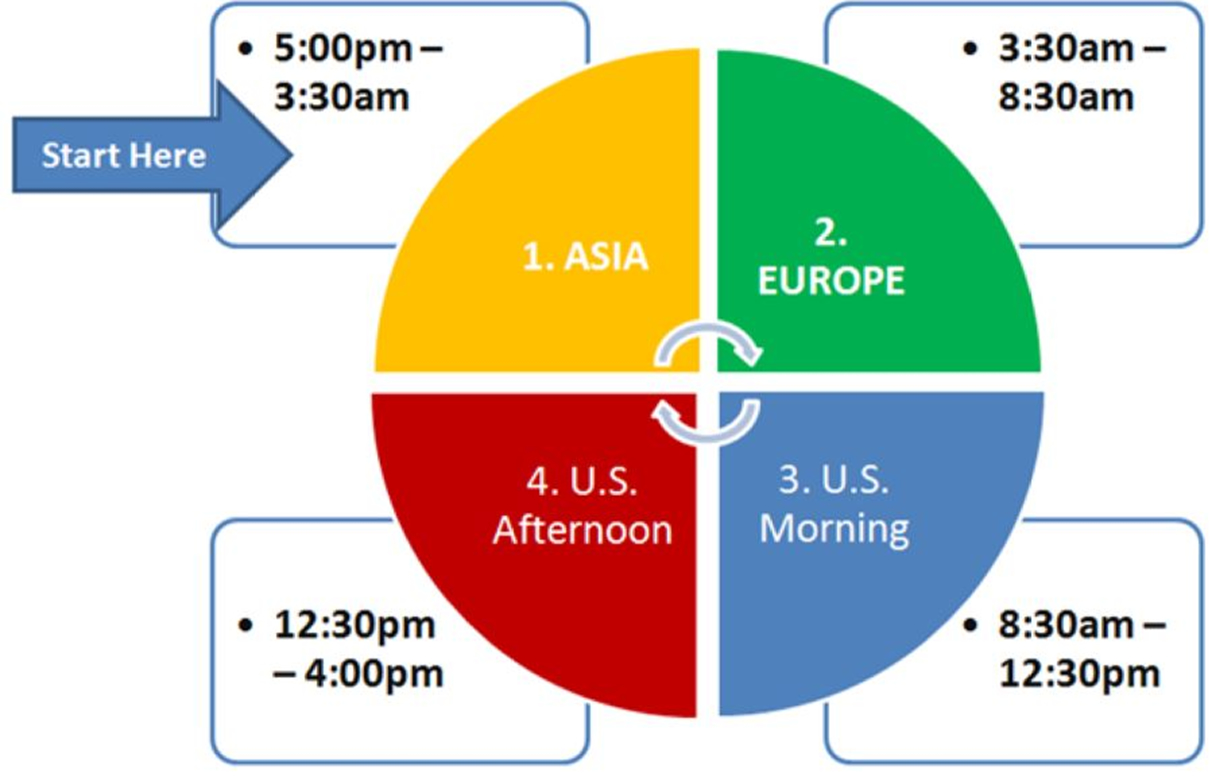

To maximize putting the odds in your favor, we believe it is essential to analyze the 24-hour market. The DTI Method divides the market into 4 major time segments: Asia, Europe, U.S. Morning and U.S. Afternoon (see illustration below). The featured market within each time segment holds a primary influence on the markets. This means that any major news coming out of Europe will often times have a direct affect to where the U.S. market will open later that day.

Steelwood’s DTI Method focuses on two main components:

#1 Time

Timing is everything when trading the markets. Buying and selling the stock of even the most fundamentally strong company at the wrong time can be a costly mistake. We also understand that patience is sometimes vital to investment success. Herein is the dual meaning of the word time. Both are equally as important to short-term and swing trades. That is why Time is the first component of the DTI Method. We recognize the best Times of Day to trade the 24-hour global market and we frame the “big picture” trend in the markets in order to formulate our longer term strategy.#2 Key Numbers

Understanding Key Numbers such as Opens, Pivots, Support and Resistance holds great importance in identifying where a market has been and where it may go next. Some advisers are familiar with market generated support and resistance levels that develop due to everyday buying and selling taking place in the market. But did you know there are historical support and resistance levels as well? Over his 40 years of trading the markets, Tom Busby has identified other important support and resistance levels that tend to hold importance. At Steelwood, we call these “historical” key numbers.